The Rise of Gold IRAs: A Complete Exploration Of Precious Metallic Inv…

페이지 정보

본문

Lately, the financial panorama has seen a significant shift as traders search various avenues for wealth preservation and development. Amongst these low-fee options for investing in gold iras, Gold Particular person Retirement Accounts (IRAs) have emerged as a well-liked choice for these trying to diversify their retirement portfolios. This text delves into the intricacies of Gold IRAs, inspecting their benefits, risks, and the components driving their increasing adoption.

Understanding Gold IRAs

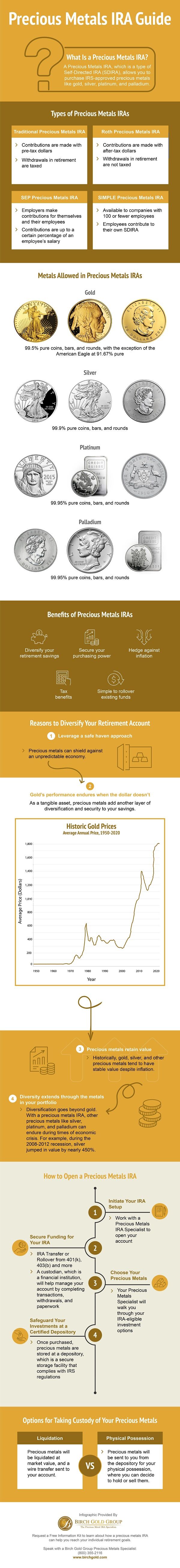

A Gold IRA is a kind of self-directed Individual Retirement Account that allows buyers to carry physical gold, together with other valuable metals, as part of their retirement financial savings. Unlike conventional IRAs, which usually invest in stocks, bonds, or money, Gold IRAs present a tangible asset that can serve as a hedge towards inflation and market volatility.

The belongings held in a Gold IRA must meet particular purity requirements set by the interior Revenue Service (IRS). Eligible metals embrace trusted gold ira options, silver, platinum, and palladium, with gold being the most sought-after choice. Investors can select to hold varied forms of gold, together with coins, bars, and rounds, supplied they meet the required purity ranges.

The Appeal of Gold IRAs

- Hedge Against Inflation: One of the primary reasons buyers flip to Gold IRAs is the asset's historic performance during inflationary intervals. Not like fiat currencies, which can lose worth resulting from inflation, gold has maintained its purchasing power over time. This characteristic makes it a lovely possibility for these involved about the eroding value of their retirement savings.

- Portfolio Diversification: Monetary consultants usually recommend diversification as a technique to mitigate danger. Gold IRAs permit investors to diversify their retirement portfolios by including a non-correlated asset. In occasions of economic uncertainty, gold often performs nicely when stocks and bonds falter, providing a buffer towards market downturns.

- Tangible Asset: Unlike paper assets, gold is a physical commodity that buyers can hold in their palms. This tangibility can provide a way of safety, especially during occasions of financial distress. The thought of getting a portion of one's retirement savings in a physical asset could be comforting for a lot of.

- Tax Benefits: Gold IRAs provide the same tax benefits as traditional IRAs. Contributions could also be tax-deductible, and the safe investment in precious metals ira grows tax-deferred until withdrawals are made throughout retirement. This tax benefit can enhance the general returns on funding.

The Dangers and Concerns

While Gold IRAs supply a number of advantages, they aren't without risks and issues that potential buyers ought to keep in mind.

- Market Volatility: Though gold is often viewed as a stable funding, its worth can be risky in the short time period. If you enjoyed this short article and you would certainly like to receive more facts pertaining to affordable gold ira providers in usa kindly see the webpage. Elements resembling geopolitical tensions, forex fluctuations, and changes in curiosity charges can influence gold prices. Traders must be ready recommended firms for gold-backed ira potential worth swings and may view gold as a long-term funding.

- Storage and Insurance coverage Costs: Holding physical gold comes with extra costs, including secure storage and insurance. Gold IRAs require that the bodily metals be saved in an accepted depository, which typically prices charges for storage and insurance. These costs can eat into general returns, so buyers ought to factor them into their resolution-making course of.

- Restricted Development Potential: Not like stocks or real property, gold does not generate revenue or dividends. Its value is primarily derived from market demand and supply dynamics. Because of this, investors should consider how much of their portfolio they wish to allocate to gold, balancing it with other belongings which will provide development potential.

- Regulatory Considerations: Gold IRAs are topic to specific IRS regulations, together with the forms of metals that may be held and the requirements for storage. Buyers ought to guarantee they are working with a reputable custodian who understands these laws to avoid potential pitfalls.

The Growing Reputation of Gold IRAs

The rising interest in Gold IRAs could be attributed to a number of elements. Financial uncertainty, rising inflation charges, and geopolitical tensions have prompted buyers to seek safer havens for his or her wealth. Moreover, the rise of digital platforms and self-directed investing has made it easier for individuals to establish and manage Gold IRAs.

In response to industry stories, the demand for precious metals, notably gold, has surged in recent times. Many buyers view gold as a protected-haven asset during turbulent times, resulting in a spike in Gold IRA accounts. Financial advisors are increasingly recommending gold as part of a balanced funding technique, further fueling its popularity.

Conclusion

Because the financial panorama continues to evolve, Gold IRAs have carved out a distinct segment for themselves as a viable funding possibility for retirement savings. With their potential to hedge in opposition to inflation, diversify portfolios, and provide tangible property, Gold IRAs appeal to a broad spectrum of buyers. However, prospective buyers should fastidiously weigh the associated risks and costs earlier than diving into this alternative funding.

Ultimately, Gold IRAs symbolize a blend of tradition and modern investment strategies, permitting people to take management of their retirement financial savings while safeguarding their wealth in an unpredictable world. As extra traders recognize the value of valuable metals in their portfolios, the future of Gold IRAs appears promising, marking a significant shift in how people approach retirement planning.

- 이전글Exciting u31 Gamings at Leading Thailand Online Casino 25.11.03

- 다음글Play Exciting Slot Gamings totally free Online in Thailand 25.11.03

댓글목록

등록된 댓글이 없습니다.